Business checks checks are a vital tool for UK businesses, helping companies manage payroll, vendor payments, and other financial obligations in a professional and secure manner. Unlike personal checks, business checks checks offer features such as branding, accounting software integration, and enhanced security measures. These checks are an essential part of day-to-day financial management, ensuring accurate record-keeping and smoother cash flow.

Using business checks checks allows businesses to demonstrate professionalism and reliability to clients, suppliers, and employees. By incorporating company logos, custom layouts, and colours, businesses can create a consistent brand image while maintaining compliance with UK banking regulations. Whether you operate a small start-up or a larger organisation, business checks checks streamline processes and reduce the likelihood of financial errors.

Types of Business Checks Checks

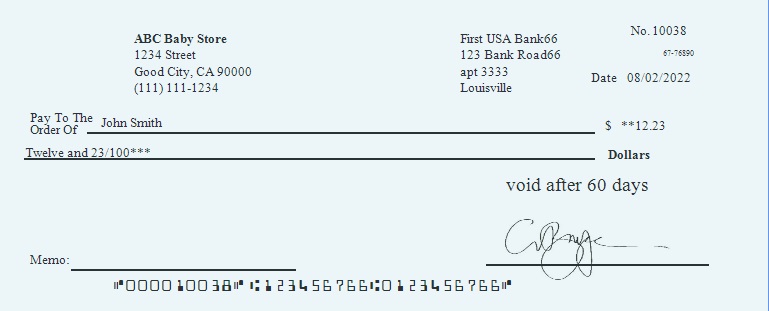

Business checks checks are available in a variety of types to suit different business needs. Manual business checks checks are ideal for small companies or businesses with low-volume payments. These checks require manual writing and recording, offering simplicity and control while avoiding the need for specialised printing equipment. They are a cost-effective choice for businesses just starting out or those handling fewer transactions.

Laser and inkjet business checks checks provide a modern, high-volume solution compatible with accounting software like QuickBooks. These checks allow businesses to print multiple payments efficiently and include stubs for payroll or expense tracking. Voucher and travel business checks checks are also available, offering detailed record-keeping and security features, making them particularly useful for companies with employees who frequently travel or work remotely.

Ordering Business Checks Checks in the UK

Ordering business checks checks in the UK has never been easier, with numerous online providers offering free shipping business checks. Businesses can place orders online and customise their checks to include logos, company names, and preferred colours. Many providers also offer bulk discounts, making it cost-effective for companies with high payment volumes. Local suppliers, including providers in Edinburgh and other major cities, ensure UK businesses receive checks quickly and securely.

For QuickBooks users, ordering business checks checks directly through accounting software providers guarantees compatibility. This approach reduces errors, saves time, and ensures that all printed checks are formatted correctly for accounting purposes. Whether ordering manual, laser, or voucher checks, UK businesses benefit from the convenience of online ordering, free shipping options, and customisation to create professional, secure business checks checks tailored to their specific needs.

Customising Business Checks Checks

Customisation is one of the key advantages of using business checks checks. Businesses can incorporate logos, colours, and unique layouts to reflect their brand identity while enhancing professionalism. Adding these elements not only improves the presentation of payments but also helps prevent fraud by making it more difficult for counterfeit checks to be produced. UK businesses increasingly view customisation as a critical feature of their financial management strategy.

In addition to branding, businesses can select different check formats, including top, middle, or bottom placement of check details, and choose between laser or manual printing. Some business checks checks come with stubs for detailed record-keeping, making it easy to track payments, reconcile accounts, and maintain accurate financial documentation. This combination of customisation and functionality ensures that business checks checks remain a valuable tool for companies of all sizes.

Benefits of Business Checks Checks

Business checks checks provide several benefits beyond simple payment processing. They help maintain accurate accounting records, improve cash flow management, and ensure compliance with UK banking regulations. By integrating with software like QuickBooks, business checks checks allow businesses to automatically record transactions, reducing errors and saving time during reconciliation.

Another significant advantage of business checks checks is enhanced security. Many checks include features such as watermarks, microprint, and security inks that protect against fraud and forgery. This protection is particularly important for businesses making large payments or handling sensitive financial information. In addition, business checks checks convey professionalism, instilling trust in clients, suppliers, and employees alike.

Managing Business Checks Checks Effectively

Effective management of business checks checks is essential for any business. Keeping track of issued and cashed checks, reconciling accounts, and maintaining detailed records ensures smooth financial operations. Automated know your business checks checks can help UK companies detect irregularities, maintain compliance, and prevent fraud, making them a valuable addition to financial management systems.

Proper storage and organisation of business checks checks also contribute to efficiency and security. Custom business checks checks with unique designs or logos minimise the risk of misuse, while consistently monitoring check usage ensures timely reordering. Regularly reviewing check practices and incorporating software solutions enhances financial oversight, reduces administrative workload, and ensures that business checks checks remain a reliable part of your company’s operations.

Choosing the Best Place to Order Business Checks Checks

Selecting the right supplier for business checks checks is crucial. Businesses should consider pricing, delivery speed, quality, and customisation options when choosing a provider. UK-based providers offering free shipping business checks are ideal, as they combine convenience with reliability, helping companies maintain smooth operations without delays.

QuickBooks users may benefit from ordering business checks checks directly through compatible software providers, ensuring proper formatting and compatibility. For businesses seeking custom business checks checks with logos or stubs, reputable suppliers offer a range of formats and security options. Choosing the best place to order business checks checks ultimately ensures professional presentation, secure payments, and compliance with accounting requirements.

Conclusion

Business checks checks are indispensable for UK businesses, providing a secure, professional, and efficient method of managing payments. From manual checks to laser and voucher options, they offer flexibility, customisation, and integration with accounting software like QuickBooks. By using business checks checks, companies improve accuracy, reduce errors, prevent fraud, and maintain a professional brand image in every financial transaction.

You may also read: Styling Tips for Business Casual Attire for Men