Hire and reward insurance is a must-have for anyone earning money by transporting goods or passengers in the UK. Standard car insurance does not cover paid driving activities, which means drivers for Uber, Bolt, Amazon Flex, or Deliveroo need a specialist policy. Without the right cover, you risk driving illegally and invalidating your insurance, which can result in heavy fines or even the loss of your livelihood.

As the gig economy grows, more people are looking for affordable ways to insure their vehicles while working flexibly. Whether you are a full-time taxi driver, a part-time courier, or a food delivery driver, hire and reward insurance provides legal protection and peace of mind. With competition in the insurance market, comparing providers can help you secure the cheapest hire and reward insurance that still offers reliable cover.

What is Hire and Reward Insurance

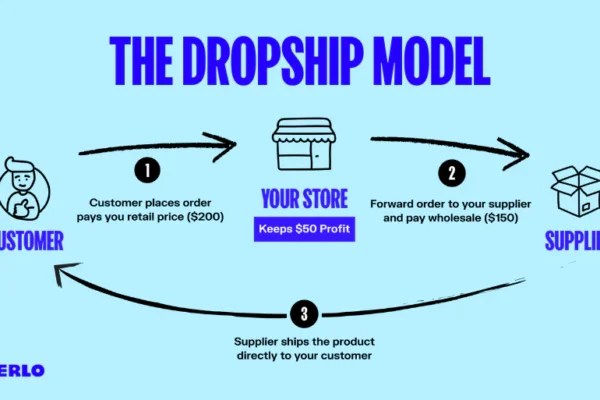

Hire and reward insurance is a form of commercial motor insurance designed to cover drivers who are paid to carry passengers, food, or parcels. This includes taxi drivers, private hire vehicles, couriers, and delivery drivers. Unlike standard insurance, it recognises that working vehicles are at higher risk due to longer hours, busier routes, and the nature of the job.

If you only hold standard car insurance but use your vehicle for deliveries or passenger work, you will not be covered in the event of an accident. Hire and reward insurance ensures you are operating legally under UK law, protecting both you and your customers. It provides a safety net for financial claims, vehicle repairs, and liability cover if something goes wrong during a paid journey.

Types of Hire and Reward Insurance in the UK

The type of hire and reward insurance you need depends on your work. Private hire insurance is essential for minicab drivers and ride-hailing apps such as Uber and Bolt. Public hire insurance is required for drivers of black cabs and hackney carriages who can legally pick up passengers without pre-booking. These policies provide the right protection for professional passenger services.

Couriers and delivery drivers require a different type of hire and reward insurance that covers the carriage of goods. This includes parcel deliveries, fast food transport, and same-day courier services. For drivers who do not work full time, pay as you go hire and reward insurance offers flexible cover that can be activated only when working. Temporary policies are also available for short-term contracts or seasonal jobs, making them suitable for part-time couriers.

Hire and Reward Insurance for Food Delivery and Amazon Flex

Food delivery drivers working for Deliveroo, Uber Eats, or Just Eat must have hire and reward insurance. These drivers face risks such as tight deadlines, heavy traffic, and late-night routes, which increase the chances of accidents. Specialist food delivery insurance provides protection while ensuring compliance with both company requirements and UK law. Without it, your standard insurance will not cover food delivery.

Amazon Flex drivers also need hire and reward insurance to carry parcels. Since Amazon’s service relies on private drivers using their own vehicles, proof of insurance is required before starting work. Providers such as Admiral, Acorn, INSHUR, and Zego offer tailored cover for Amazon Flex. Whether you are working a few shifts per week or delivering full time, having the correct insurance avoids legal complications and financial risks.

How Much is Hire and Reward Insurance in the UK

The cost of hire and reward insurance varies depending on several factors. New drivers and those with little experience often face higher premiums, while seasoned drivers with clean records can access cheaper cover. Other elements that affect cost include your age, type of vehicle, location, and the nature of your work — food delivery drivers in busy cities usually pay more than rural taxi drivers.

On average, part-time food delivery cover may start from a few hundred pounds per year, while full-time taxi insurance can run into several thousand. Pay as you go policies help keep costs lower by charging only for the hours or days you actually work. To find the cheapest hire and reward insurance, it’s essential to compare quotes from multiple providers and tailor the policy to your specific driving needs.

Best Hire and Reward Insurance Providers in the UK

Several insurers in the UK specialise in hire and reward insurance, each with different strengths. Admiral offers comprehensive cover for delivery and taxi drivers, while Acorn is known for working with new drivers who may struggle to get affordable quotes elsewhere. INSHUR provides app-based instant policies for private hire drivers, making it convenient for those who want quick, flexible solutions.

Zego is popular for pay as you go hire and reward insurance, which is particularly useful for part-time drivers and Amazon Flex couriers. Quotax, on the other hand, is well-regarded for offering tailored cover to taxi drivers, couriers, and fleet operators. When choosing the best hire and reward insurance, consider the type of driving you do, your budget, and whether you need full-time, part-time, or temporary cover.

Pay As You Go and Temporary Hire and Reward Insurance

Pay as you go hire and reward insurance has become increasingly popular in the UK, especially with drivers who do not work full time. Instead of paying for a yearly policy, you only pay for the hours or days you drive. This makes it a cost-effective option for students, part-time drivers, or those who deliver on flexible schedules such as Amazon Flex.

Temporary hire and reward insurance is ideal for seasonal work or one-off delivery jobs. For example, drivers who only deliver parcels during busy holidays like Christmas can benefit from short-term cover. Both pay as you go and temporary policies provide legal protection without locking you into a long-term commitment, ensuring flexibility while keeping costs down.

How to Find the Cheapest Hire and Reward Insurance in the UK

Finding cheap hire and reward insurance starts with comparing quotes from multiple providers. Online comparison websites can help, but it’s often worth contacting insurers directly to see if they offer discounts for safe drivers or low-risk vehicles. Some companies also provide cheaper rates for drivers who install telematics or dash cams that prove careful driving.

Another way to cut costs is by choosing the right type of cover. If you only drive occasionally, pay as you go hire and reward insurance may be the most affordable option. Drivers with multiple vehicles can benefit from fleet policies, while experienced drivers with clean records are often rewarded with lower premiums. Taking time to research the cheapest hire and reward insurance will pay off in long-term savings.

Conclusion

Hire and reward insurance is more than just a legal requirement — it is a vital safeguard for anyone working as a taxi driver, food courier, or delivery driver in the UK. It ensures you are protected against accidents, liability, and financial loss while earning money on the road. Without the right cover, both your job and financial security are at risk.

The best approach is to compare policies, consider your driving needs, and select the right balance between affordability and protection. From temporary options for part-time drivers to full cover for professional taxi operators, there is a hire and reward insurance policy suited to every situation. With the right choice, you can work with confidence and security.

FAQs About Hire and Reward Insurance

Q1. What does hire and reward insurance cover?

Q2. How much is hire and reward insurance in the UK?

Q3. Do I need hire and reward insurance for Amazon Flex?

Q4. What is the cheapest hire and reward insurance available?

Q5. Can I get temporary hire and reward insurance?

Q6. Is pay as you go hire and reward insurance worth it?

Q7. Do new drivers pay more for hire and reward insurance?

Q8. Which is better for food delivery – private hire or courier insurance?

Q9. Can I use Admiral or Acorn for hire and reward cover?

Q10. How do I compare the best hire and reward insurance providers in the UK?

You may also read: Kind Protein Bars – Healthy Protein Snacks, Flavours & Nutrition