When people search for the phrase what does a bank statement look like, they are usually trying to understand how banks present their financial records and what kind of details they include. A bank statement is not just a random document; it is an official record of every financial movement that has taken place in your account over a set period. This includes deposits, withdrawals, direct debits, card payments, fees, and sometimes interest earned.

In the United Kingdom, banks issue statements regularly, usually every month, though some may also offer weekly or quarterly versions depending on your preferences. These can arrive by post in paper format or be accessed instantly online in digital form. Knowing what does a bank statement look like and how to read one is important because it allows individuals and businesses to monitor spending, identify suspicious activity, and maintain accurate records for financial planning.

What is a bank statement

A bank statement is an essential financial document that serves as proof of account activity. It shows all money going in and out, along with the opening and closing balances for the period. It is often required as part of applications for loans, mortgages, tenancy agreements, or even visa requests, as it provides official evidence of income and expenses.

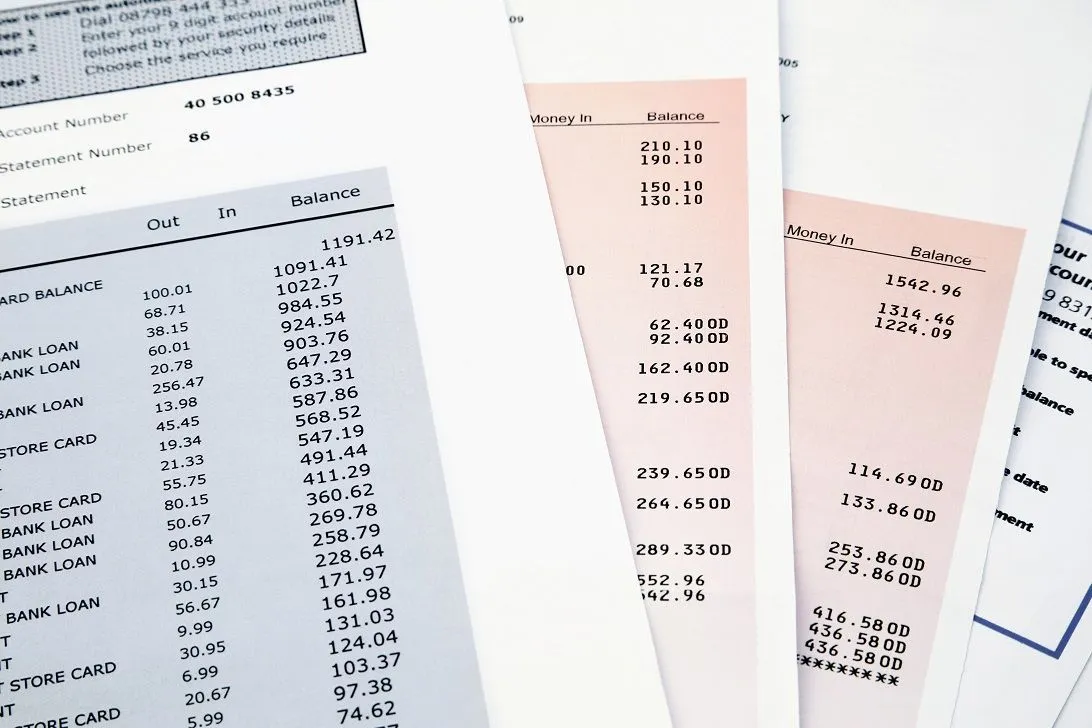

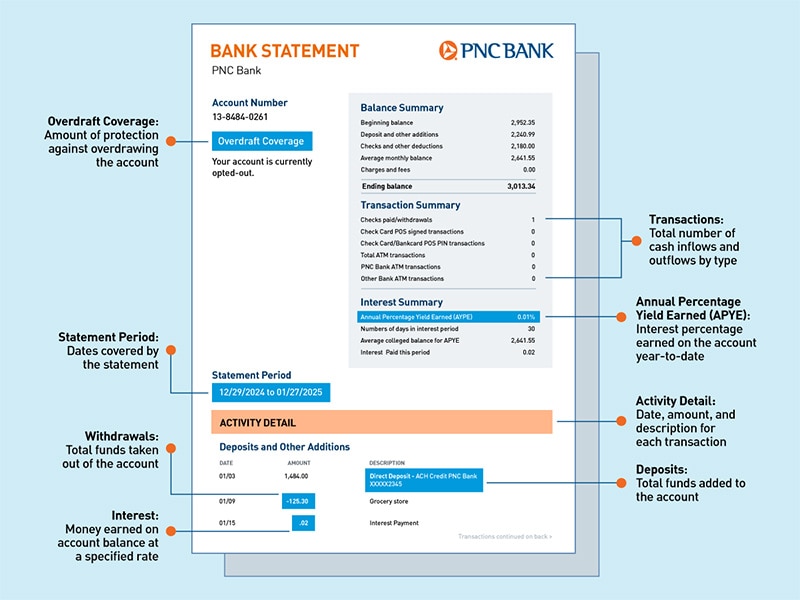

For those asking what does a bank statement look like, the answer lies in its structured format. Typically, the top section contains your personal information, such as your name and address, followed by your account number and the bank’s details. The main section lists every transaction in chronological order, ensuring you have a clear view of how money flows in and out of your account.

What does a bank statement look like

When considering what does a bank statement look like, it helps to think of it as a highly detailed financial diary. At the very top, you will find your personal details and bank information. Below this, the statement specifies the time period it covers, usually a month, and provides an opening balance. The bulk of the document is a line-by-line breakdown of every single financial movement.

Most UK bank statements also highlight whether transactions are pending, cleared, or scheduled for a later date. At the end of the document, you will find a closing balance, which tells you the final amount left in your account at the end of the period. Digital versions often look cleaner, with tables and filter options to make it easier for customers to track spending. Paper statements, however, are often more traditional, resembling long receipts.

Key components of a bank statement

The best way to answer the question, what does a bank statement look like, is to break down its components. The first section is the account holder’s information, which includes your full name, registered address, and sometimes contact details. Next comes the bank’s information, which features the institution’s name, branch address, and customer service contact numbers.

The heart of the statement is the transaction section. Here, every payment, deposit, withdrawal, and fee is recorded with the date, description, and amount. Direct debits, standing orders, salary payments, and card purchases all appear in order. This section provides the clearest picture of how you manage your money. At the end, the statement shows the final closing balance, helping you compare with the opening figure and track overall financial changes.

How to read and understand a bank statement

Reading a bank statement for the first time can feel overwhelming, but once you know what does a bank statement look like, it becomes far more straightforward. Start by checking the account details and personal information at the top. This confirms the document belongs to you and ensures that there are no errors with your identity or account details.

Next, move on to the transaction section. Check the statement period to see which days it covers and then compare the opening balance with the closing balance. Review each entry carefully, paying close attention to unusual charges, duplicate transactions, or fees you do not recognise. By doing this regularly, you not only manage your money more effectively but also protect yourself from fraud and errors.

Why bank statements are important

Asking what does a bank statement look like is not just about appearance but also about understanding its purpose. For individuals, bank statements act as proof of income, which is essential for credit card applications, rental agreements, or mortgage approvals. Without this document, it would be very difficult to prove your financial reliability.

For businesses, the importance is even greater. Bank statements serve as official records for bookkeeping, tax submissions, and audits. They allow business owners to monitor cash flow, verify supplier payments, and ensure that employees are paid correctly. Whether you are an individual or a business, having a clear idea of what your bank statement looks like ensures financial accuracy and accountability.

Examples of bank statements

When describing what does a bank statement look like, it is useful to think of real-life examples. A personal bank statement often includes salary deposits, card transactions for groceries or shopping, and direct debits for bills such as utilities or subscriptions. It provides a comprehensive overview of day-to-day financial activity and helps individuals manage budgets more effectively.

A business bank statement, on the other hand, may contain invoices paid by clients, payments to suppliers, staff wages, and operating expenses. These statements are often reviewed in detail by accountants and financial advisers. In digital banking, downloadable PDF statements mirror traditional paper versions, but with added convenience, allowing you to search transactions and organise finances quickly.

Common questions and problems with bank statements

Many people who wonder what does a bank statement look like also have concerns about unusual entries or confusing terminology. For instance, payments may take time to clear, meaning the statement shows them under the merchant’s official trading name rather than the shop name customers recognise. This often causes confusion but is perfectly normal in banking.

Another frequent issue is finding errors or unexplained charges. In such cases, contacting your bank promptly is essential. Banks in the UK keep records for several years, and customers can usually request older statements when needed. These documents also serve additional purposes, such as acting as proof of address, which is often required when opening new accounts or applying for official services.

Conclusion

In conclusion, what does a bank statement look like is a question that leads to financial awareness and better money management. A bank statement is a structured document that includes personal details, account information, transaction records, and balances. Whether in paper or digital format, it provides a transparent record of your finances and helps you stay on top of your money.

By regularly reviewing your bank statement, you can detect errors early, prevent fraud, and maintain a healthy financial record. It is not only a tool for tracking income and expenses but also an important document for proving financial stability. Understanding what a bank statement looks like gives you confidence in your financial management and ensures greater security for the future.

You may also read: Green Belt Map UK – Interactive Guide to Protected Land 2025